Explore how global luxury brands engage China’s affluent shoppers through mobile events, influencers, and localized platforms. Learn why language solutions are critical to win in this fast-evolving market.

“Chinese shoppers are big spenders.”

Chinese Consumers’ Spending Habits on Luxury Items

Chinese consumers play a crucial role in the global luxury market, accounting for 30% to 50% of worldwide luxury purchases, according to Jing Daily.

Now what? As a global company, what can you do or how can you take advantage of this growing industry?

READ MORE >>> 5 Things You Need to Know About China’s Single’s Day Shopping Frenzy

The luxury market in China: Behind the purchasing power

There are several contributing growth drivers that shape the spending habits of luxury shoppers. These are the rise of middle-class disposable income, the consumer’s preferences of luxury products for quality and value, and also the opportunity to show one’s social status, which is a significant driver for the affluent millennials.

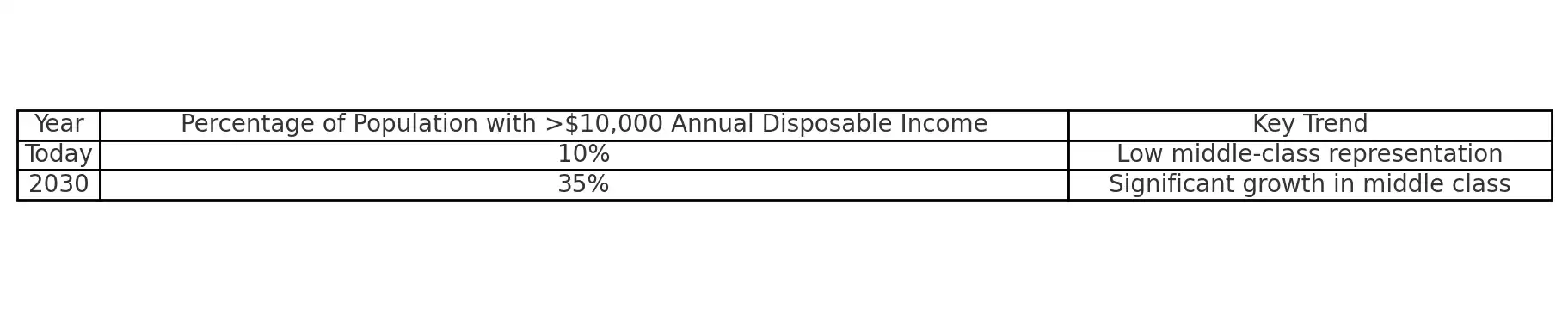

An increase of income results to an increase of spending and improved lifestyle. And according to research firm, Economist Intelligence Unit, the middle class in China is expected to rise to more than third of population by 2030.

“About 35 per cent of the population will have in excess of US$10,000 of annual disposable income by then, up from about 10 per cent today, according to the report released on Wednesday by The Economist Intelligence Unit. As development deepens, wealth will depend more on capital rather than labour,” the South China Morning Post wrote.

Consumer’s preference for luxury products because of the quality and value

Because of the explosive growth of the internet in China, shoppers have become digitally-savvy more than ever. They are more discerning and have access to information about the products and services.

Community-based information, peer-to-peer recommendation are some of the ways on how they educate themselves, and as they pursue these products, their preferences are more of the quality and value these products and services provide.

Luxury is being redefined as well, as some visible trends such as shifting from branded goods to niche high-end bespoke products drive consumption, while it somehow affects the sales of prominent branded names.

As Dr. Zhou said via The New York Times, “Our research found that 39 percent of wealthy Chinese think the logo is no longer the priority.”

Did You Know?

There are platforms where Chinese consumers actively find information and recommendations before making decisions. These combine community-driven content and trusted reviews to guide their choices. Here’s a quick look:

- 🚩 Xiaohongshu (Little Red Book): A top platform for discovering beauty, fashion, and lifestyle tips, featuring authentic user reviews and experiences.

- 📚 Douban: Loved by intellectuals for books, movies, and cultural product recommendations.

- ✈️ Mafengwo: A travel hub offering real-life guides, itineraries, and tips from seasoned travelers.

- 💡 Zhihu: China’s Quora-like platform, providing expert advice and detailed answers across diverse topics.

- 🍽️ Dianping: Think Yelp for China—find restaurant reviews, local services, and exclusive deals.

- 🛍️ Taobao Communities: Merging shopping and community, where influencers recommend products, live streams showcase items, and users shop confidently.

Showcase social status and other forms of luxury

Wine is one of the famous luxury products among Chinese consumers a decade ago. Today, the luxury for enjoyment and the opportunity to showcase of one’s social status can be in the form of high-end fashion, travel and tourism, automobile and among others.

And one can’t overlook the affluent Chinese millennials’ pursuit of self-actualization, which is clearly evident in the way they spend their money. And the need to discover one’s potential in the here and now is what they value.

Luxury brands that share the same values with them can easily engage with them. As these shoppers believe in multidimensional lives, “embodying multiple mindsets, beliefs and connections is what defines luxury for them.”

How global luxury companies engage with consumers?

🈴Fashion translation in chinese

Despite the economic instability, the overall luxury market is expected to grow at a steady pace while both recognized brands and bespoke luxury product makers will constantly find ways to drive sales and engage with customers.

Here’s how some of the prominent luxury brands do it:

1. Convergence of mobile marketing and experiential events

Luxury brands are getting more creative and more digital at the same time to wow and woo the shoppers using experiential events. From Gucci to Chanel and Dior, they have launched creative events in major cities to engage with consumers offline – by providing immersive and memorable experiences – with the convergence of mobile marketing via WeChat, and in their campaigns, a fusion of art, culture, and technology.

Hermes’s event at the Long Museum in Shanghai showcased its ready-to-wear products and accessories in different artistic themes, bringing life to these products and leaving the attendees wowed and wooed where they capitalize the WeChat official account to view the embedded videos and revisit the wonderful performance using interactive HTML-5 enabled interactive page.

2. Leveraging on influencers or KOL – Key Opinion Leaders

Luxury brands have their own ambassadors – from famous artists to bloggers and internet celebrities – and leveraging on their followers and network. They’re a hot commodity among global brands where they use them to fuel sales. Michael Kors recently unveiled its new ambassador, Yang Mi, the famous Chinese actress and singer.

As purchasing decisions are anchored with peer-to-peer recommendations, these KOL are true media vehicles. But there’s a price to pay for global companies, as they will shell out millions and billions of dollars. “Jaeger-LeCoultre paid at least U$731,000 for Ms. Papi Jiang’s 30-second video, estimates Kevin Gentle of Major, a digital branding agency the Financial Times wrote.

Which Localization of communication channels can help you in China ?

Knowing and understanding your customer’s digital habits will give you a clear direction when it comes to localization strategy. Of course, the bulk of your audience is in the Mainland, and mainstream social media networks like Facebook, Twitter, Google, YouTube and among others are not available🚫.

Companies need to be present on where the consumers hang out online and because of the pervasiveness of WeChat ✔in their digital lives, they need to set up official accounts and get creative on how to engage with users such as the use of mobile advertisements within the app.

Weibo✔, China’s Twitter-like, microblogging platform is also being used by luxury brands with the help of online celebrities and influencers who have a huge number of followers.

And because videos are powerful marketing tools to tell their stories, Youku✔, iQiyi✔, and other video platforms are go-to of these companies for promotional Chinese videos.

The Rewards of Language Solutions: Unlocking Opportunities Worldwide

n an increasingly globalized world, businesses must think beyond borders—not just in strategy but in communication. While global companies may excel in running their operations outside of China, they often overlook a critical factor: many consumers are travelers. Whether they visit your shops, stores, restaurants, or offices, the exposure of your brand is no longer limited to Mainland China—it extends globally, from the US to Europe to Africa.

Still Not Convinced?

Consider this: A report by Common Sense Advisory, “Translation at Fortune 500 Companies,” highlights the tangible rewards of investing in language solutions. It states that companies dedicating resources to translation and localization are seeing higher revenues. Here’s what they found:

- Revenue Growth: Large firms that increased their translation budgets were 1.5 times more likely than their Fortune 500 peers to see a boost in total revenue.

- Profitability: Companies translating content to meet local regulatory or legal standards were 1.86 times more likely to experience revenue increases. Additionally, they were 1.33 times more likely to report higher profits.

Ready to Explore the World of Language Solutions?

Don’t let your brand’s voice get lost in translation. Learn how language solutions can elevate your business in China and beyond. Click the image below to contact our team and unlock the power of global communication. Let’s collaborate to take your business to the next level!