China’s e-commerce market continues to evolve at record pace. With mobile shopping, livestream commerce, and cross-border platforms reshaping consumer behavior, 2025 offers global brands new opportunities to engage China’s massive online audience.

1. E-commerce in China: Still Breaking Records

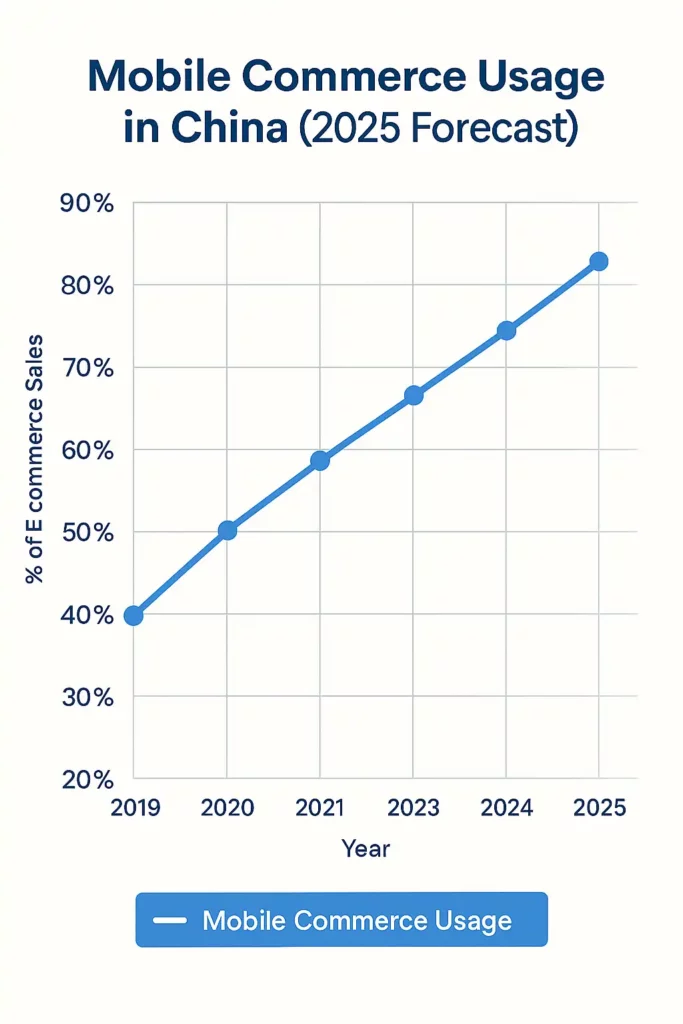

In 2024, China’s total e-commerce sales exceeded ¥15 trillion, cementing its position as the world’s largest online market. Mobile devices accounted for over 84% of transactions, driven by platform optimization, seamless mobile payments, and short-video shopping features.

Global retail sales topped \$30 trillion, and China remained the dominant player in digital commerce. The country’s deep-rooted digital habits and growing middle class are expected to fuel 8% year-on-year growth through 2025

2. Singles’ Day 2024: Bigger Than Ever

In November 2024, Singles’ Day (Double 11) generated over ¥1.3 trillion (\$180B) in gross merchandise volume (GMV), marking a record 8% growth year-over-year. Sales during the first 10 minutes alone hit ¥30 billion (\$4.2B).

The event has evolved into a multimedia festival featuring celebrity livestreams, AR-powered games, flash sales, and limited-time bundles. Over 80% of traffic came via mobile, and livestream commerce contributed more than ¥100 billion (\$14B) in sales.

3. The Rise of Livestream & Mobile Shopping

China’s consumers are mobile-first: over 980 million people shop via mobile devices, and 65% engage in livestream shopping monthly.

Short-video platforms like Douyin and Kuaishou integrate entertainment with commerce. Influencers showcase products in real time, answer questions, and trigger one-click purchases. These features turn browsing into impulse buying.

Even luxury brands have joined the trend, launching exclusive lines via livestreams with top-tier influencers.

4. Cross-Border E-commerce: Smoother Than Ever

China has made it easier than ever for foreign brands to reach local consumers.

Thanks to bonded warehouse policies and simplified customs for B2C imports, platforms like Tmall Global, JD Worldwide, and Kaola are onboarding smaller overseas sellers at unprecedented speed.

In 2025, the average clearance time for cross-border parcels dropped below 24 hours in top-tier cities. Foreign products from health, beauty, fashion, and baby categories are among the bestsellers.

🚚 Key Numbers (2025 Update):

| Metric | Value |

|---|---|

| Avg. customs clearance time | < 24 hours in Tier-1 cities |

| Bonded warehouse coverage | 105 zones across 50+ cities |

| Cross-border e-com value | ¥3.1 trillion (~$430B USD) |

| No. of cross-border consumers | Over 200 million |

| Top product categories | Health, beauty, baby, pet, supplements |

| Main platforms | Tmall Global, JD Worldwide, Kaola, Douyin |

⚡ In 2025, over 30% of imported goods to China were sold via cross-border e-commerce platforms — up from just 18% in 2020.

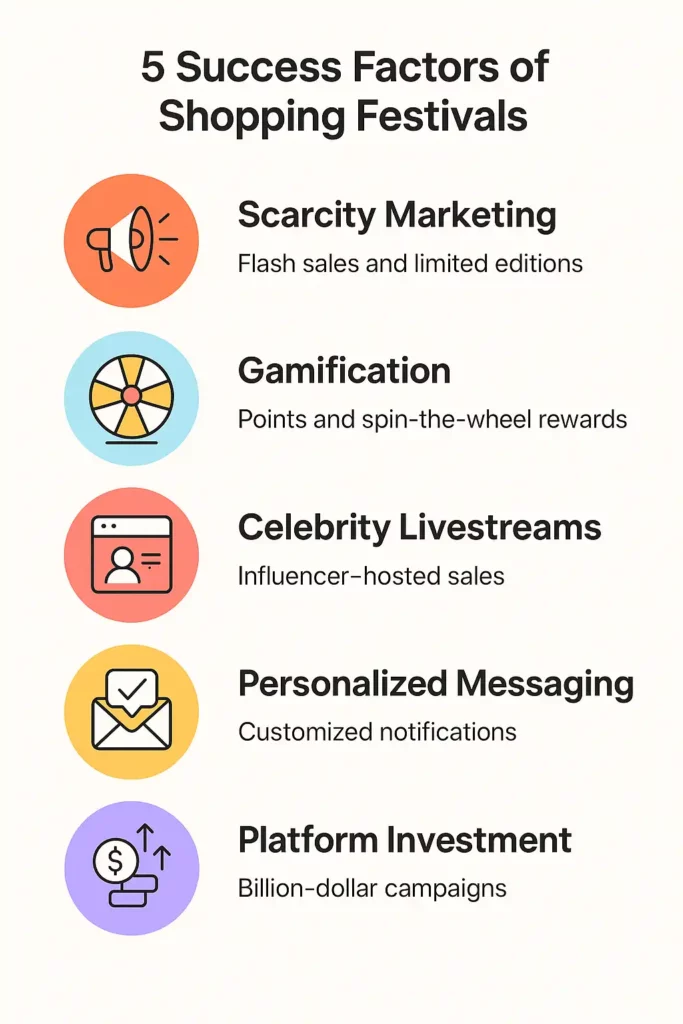

5. Why China’s Shopping Festivals Work So Well

What makes events like Singles’ Day so effective?

- Flash deals & scarcity marketing: Products sell out in seconds

- Celebrity livestreams: Global stars like Katy Perry and local idols attract massive attention

- Gamified experiences: Coupons, spin-the-wheel, and referral bonuses keep users engaged

- AI-powered recommendations: Personalized push notifications match users with relevant deals

- Multi-platform integration: Consumers move from social media to checkout in seconds

79% of Chinese online shoppers say personalized offers influence their buying decision

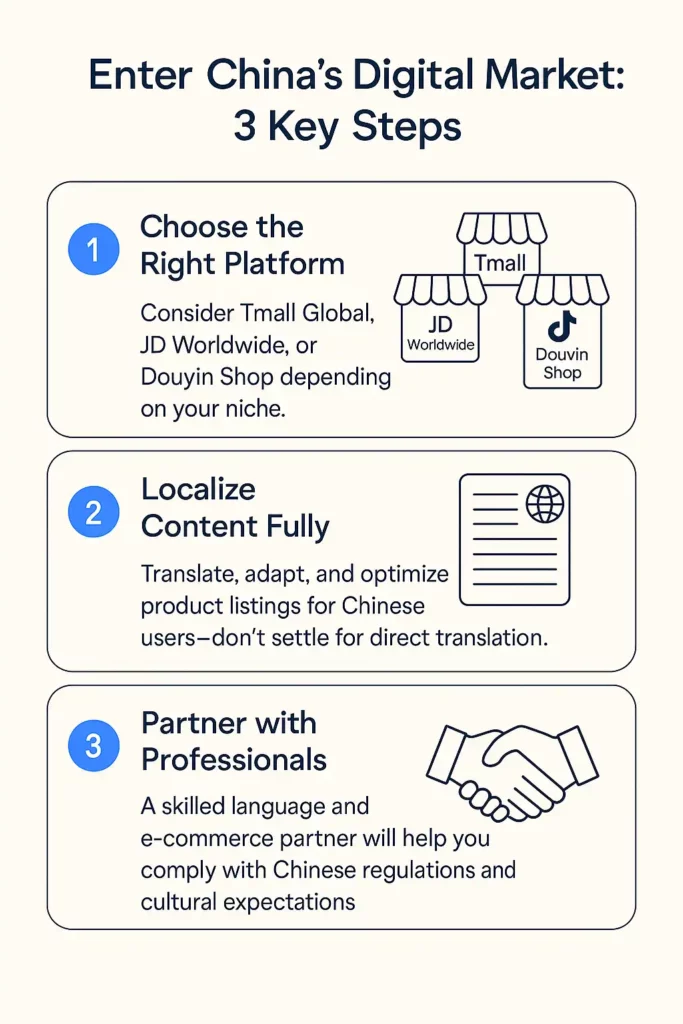

6. Action Plan for Foreign Sellers

If you’re planning to enter China’s digital market in 2025, here are 3 smart steps:

Ready to take the next step?

- 5 Best Practices in Chinese E-commerce Website Localization

- Avoid These 5 App Localization Fails in China

Breaking into China’s massive digital market requires more than just translation — it demands cultural insight, regulatory awareness, and a deep understanding of how Chinese consumers think, shop, and decide.

At AZ-Loc, we provide high-impact translation and localization services that go far beyond word-for-word conversion. With over 20 years of experience and a focus on clarity, accuracy, and user engagement, we help businesses present their products in a way that feels native, natural, and trustworthy to Chinese audiences.

Whether you’re launching a new brand or refining existing content, we’ll make sure your message doesn’t just cross borders — it connects.